UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

SCHEDULE 14A

_________________

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant | ☒ |

Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to |

SenesTech, Inc.

_______________________________________________________________

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check in the appropriate box):

☒ | No fee required. |

☐ |

| Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act |

![[GRAPHIC MISSING]](https://capedge.com/proxy/DEF 14A/0001144204-17-021100/logo_senestech.jpg)

SENESTECH, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON May 19, 2016

TO THE STOCKHOLDERS:JUNE 23, 2022

Notice is hereby given that the 2017Dear Stockholder:

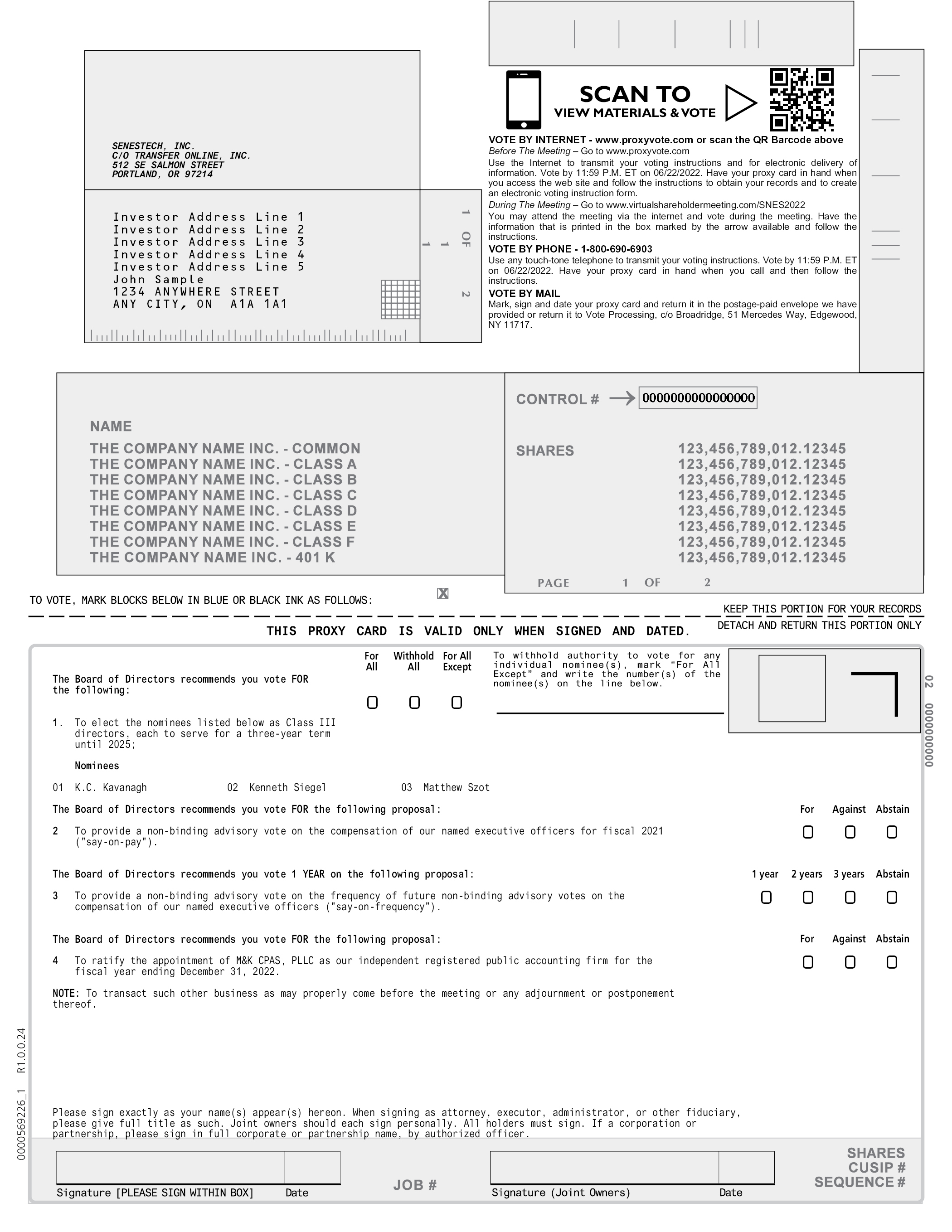

The Annual Meeting of Stockholders, or the Annual Meeting, of SenesTech, Inc., a Delaware corporation, (the “Company”), will be held on Friday, May 19, 2017Thursday, June 23, 2022 at 10:12:00 a.m.p.m., local time, atMountain Standard Time. Due to the Holiday Inn Hotel & Suites, Phoenix Airport North at 1515 N 44th St., Phoenix, AZ 85008,ongoing public health impact of the novel coronavirus COVID-19 outbreak, this year’s Annual Meeting will be a virtual meeting conducted solely via live webcast. You will be able to attend the Annual Meeting, vote your shares electronically and submit questions during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/SNES2022 and entering the 16-digit control number included on your proxy card or in the instructions that accompanied your proxy materials. You will not be able to attend the Annual Meeting in person. Additional information regarding attending the Annual Meeting, voting your shares and submitting questions can be found in the Proxy Statement.

The Annual Meeting will be held for the following purposes:

1. To elect K.C. Kavanagh, Kenneth Siegel and Matthew Szot as Class III directors, each to serve for a three-year term until the 2025 annual meeting of stockholders and until their successors are duly elected and qualified;

2. To provide a non-binding advisory vote on the compensation of our named executive officers for fiscal 2021 (“say-on-pay”);

3. To provide a non-binding advisory vote on the frequency of future non-binding advisory votes on the compensation of our named executive officers (“say-on-frequency”);

4. To ratify the appointment of M&K CPAS, PLLC as our independent registered public accounting firm for the fiscal year ending December 31, 2022; and

5. To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.Notice of Annual Meeting of Stockholders.

TheOur board of directors has fixed the close of business on April 12, 201725, 2022 as the record date for the determination of stockholders entitled to vote at this meeting. Only stockholders of record at the close of business on April 12, 201725, 2022 are entitled to receive notice of, and to vote at, the meeting and any adjournment thereof.

All stockholdersIt is important that your shares be represented and voted, regardless of whether you plan to virtually attend the Annual Meeting. You may vote in advance of the Annual Meeting on the Internet, by telephone or by completing and mailing a proxy or voting card. Voting in advance by Internet, telephone or mail will ensure your shares are invited torepresented at the Annual Meeting. If you virtually attend the meeting, in person. However,you may choose to ensurerevoke your representation atproxy and vote online during the meeting youby following the instructions at www.virtualshareholdermeeting.com/SNES2022.

We are urgedfurnishing proxy materials to mark, sign, dateour stockholders through the Internet as permitted under the rules of the Securities and returnExchange Commission. Under these rules, many of our stockholders will receive a Notice of Internet Availability of Proxy Materials instead of a paper copy of this Notice of Annual Meeting of Stockholders, the enclosedProxy Statement, our proxy card, as promptly as possible inand our Annual Report on Form 10-K, for the postage-prepaid envelope enclosed for that purpose. Any stockholder attendingfiscal year ended December 31, 2021. We believe this process gives us the meeting may vote in person even if such stockholder has previously returnedopportunity to serve you more efficiently by making the proxy materials available quickly online and reducing costs associated with printing and postage. If requested, stockholders will receive a proxy.

By Orderpaper copy of the Boardproxy materials by mail.

Loretta P. Mayer, ChairOn behalf of the Boardmanagement and Chief Executive OfficerFlagstaff,our board of directors, we thank you for your continued support and interest in SenesTech, Inc.

Sincerely, | ||

/s/ Kenneth Siegel | ||

Kenneth Siegel | ||

Chief Executive Officer |

Phoenix, Arizona

April 20, 201729, 2022

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 19, 2017:June 23, 2022: The proxy statement and annual report to stockholders are available athttp://senestech.investorroom.com/.

i

SENESTECH, INC.

PROXY STATEMENT

FOR THE 20172022 ANNUAL MEETING OF STOCKHOLDERS

PROCEDURAL MATTERS

General

The enclosed proxy is being solicited by the board of directors of SenesTech, Inc., a Delaware corporation, for use at the 2017our 2022 Annual Meeting of Stockholders, (the “Annual Meeting”)or the Annual Meeting, to be held on Friday, May 19, 2017Thursday, June 23, 2022 at 10:12:00 a.m.p.m., local time, andMountain Standard Time, or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The

Due to the ongoing public health impact of the novel coronavirus COVID-19 outbreak, this year’s Annual Meeting will be held ata virtual meeting conducted solely via live webcast. You will be able to attend the Holiday Inn Hotel & Suites, Phoenix Airport North at 1515 N 44th St., Phoenix, AZ 85008. Annual Meeting, vote your shares electronically and submit questions during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/SNES2022. You will not be able to attend the Annual Meeting in person. See “How to Attend the Meeting; Asking Questions” below for more details.

Our principal executive offices are located at 314023460 N. Caden Court,19th Avenue, Suite 1, Flagstaff,110, Phoenix, AZ 8600485027, and the telephone number at such principal executive offices is (928) 779-4143.779-4143. As used in this proxy statement, “we,” “us,” “our” and the “Company”“our company” refer to SenesTech, Inc., a Delaware corporation.

These proxy solicitation materials were mailed onOn or about April 20, 2017 to all29, 2022, we are mailing stockholders entitled to vote at the Annual Meeting.Meeting a Notice of Internet Availability of Proxy Materials, or the Notice, instead of a paper copy of this proxy statement. The Notice contains instructions on how to access those documents over the Internet, which are available at http://senestech.investorroom.com/. The Notice also contains instructions on how to request a paper copy of our proxy materials, including this proxy statement and a form of proxy card or voting instruction card.

We were incorporated under Delaware law, which specifically permits electronically transmitted proxies, provided that the transmission set forth or be submitted with information from which it can reasonably be determined that the transmission was authorized by the stockholder. The electronic voting procedures provided for the Annual Meeting are designed to authenticate each stockholder by use of a control number to allow stockholders to vote their shares and to confirm that their instructions have been properly recorded.

Record Date and Outstanding Shares

Only stockholders of record at the close of business on April 12, 2017 (the “record date”)25, 2021, or the record date, are entitled to receive notice of and to vote at the Annual Meeting. Our only outstanding voting securities are shares of common stock, $0.001 par value. As of the record date, 10,161,04212,212,283 shares of our common stock were issued and outstanding, which shares of common stock are held by approximately 867696 stockholders of record.

How Do I Attend the Annual Meeting?

The Annual Meeting will be a virtual only meeting conducted solely via live webcast.

To participate in the Annual Meeting, visit www.virtualshareholdermeeting.com/SNES2022 and use the sixteen-digit control number included on your Notice or your proxy card to enter the meeting. The live webcast will begin at 12:00 p.m., Mountain Standard Time, on June 23, 2021. We encourage you to access the virtual meeting platform at least 15 minutes prior to the start time. If you do not have a sixteen-digit control number, you will still be able to access the webcast as a guest, but you will not be able to vote your shares or ask a question during the meeting.

The virtual meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and mobile phones) running the most updated version of applicable software and plugins. Participants should ensure they have a strong WiFi connection wherever they intend to participate in the meeting. Further instructions on how to attend and participate in the Annual Meeting, including how to demonstrate proof of stock ownership, will be posted on the virtual meeting website.

1

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. Technical support will be available on the virtual meeting platform beginning at 11:30 a.m., mountain standard time, on the day of the meeting and will remain available until the meeting has finished.

Can I Submit Questions During the Annual Meeting?

If you wish to submit a question during the Annual Meeting, visit www.virtualshareholdermeeting.com/SNES2022, type your question into the “Ask a Question” field, and click “Submit.”

Questions pertinent to meeting matters will be answered during the Annual Meeting, subject to time constraints. Questions regarding personal matters, including those relating to employment, products or services or suggestions for product innovations may not be considered pertinent to meeting matters and therefore may not be answered.

How Do I Vote?

Whether you plan to attend the Annual Meeting or not, we urge you to submit your voting instructions by proxy. Voting by proxy will not affect your right to attend the Annual Meeting. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via the Internet or telephone. If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the board of directors’ recommendations as noted below. If you neither submit by proxy nor vote your shares during the Annual Meeting, your shares will not be voted if you are a registered stockholder. If your shares are held in street name, your broker, bank or other holder of record may vote your shares on certain “routine” matters. See “Quorum; Abstentions; Broker Non-Votes; Results” below for more information.

If your shares are registered directly in your name through our stock transfer agent, Transfer Online, or you have stock certificates registered in your name, you may vote:

• By the Internet or by telephone. Follow the instructions included in the proxy card to submit your voting instructions over the Internet or by telephone.

• By mail. If you received a proxy card by mail, you can have your shares voted by mail by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your shares voted, they will be voted in accordance with the board of directors’ recommendations as noted below.

• During the Annual Meeting. Log into www.virtualshareholdermeeting.com/SNES2022 and follow the voting instructions. You will need the sixteen-digit control number that is shown on your Notice or on your proxy card. Shares may not be voted after the polls close.

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Daylight Time on June 22, 2022.

If your shares are held in “street name” (held in the name of a bank, broker or other holder of record), you will receive instructions from the holder of record. You must follow the instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting also will be offered to stockholders owning shares through certain banks and brokers.

Revocability of Proxies

AnyIf you give us your proxy, given pursuant to this solicitationyou may be revoked by the person givingchange or revoke it at any time prior to its usebefore the Annual Meeting. You may change or revoke your proxy in any one of the following ways:

• if you received a proxy card, by delivering to our Secretary, at the address referenced above,signing a written instrument revoking thenew proxy or deliveringcard with a duly executed proxy bearing a later date (in either case no later than your previously delivered proxy and submitting it as instructed above;

• by submitting your proxy by the close of business on May 18, 2017)Internet or by attendingtelephone as instructed above;

2

• by notifying the Corporate Secretary of our company in writing before the Annual Meeting that you have revoked your proxy; or

• by logging into www.virtualshareholdermeeting.com/SNES2022and following the voting in person.instructions during the Annual Meeting.

Voting

Solicitation

We have retained Alliance Advisors, LLC, or Alliance, to act as a proxy solicitor for the Annual Meeting. We have agreed to pay Alliance $7,500, plus reasonable out-of-pocket expenses, for proxy solicitation services and, Solicitation

Each holder of common stock is entitled to one voteif needed, additional fees for each share held.

This solicitation of proxies is made by our board of directors, and alltelephone solicitation. All related costs will be borne by us. We may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Proxies may also be solicited by certain of our directors, officers or administrative employees without the payment of any additional consideration. Solicitation of proxies may be made by mail, by telephone, by email, in person or otherwise.

Stockholders of Record and “Street Name” Holders

Where shares are registered directly in the holder’s name, that holder is the stockholder of record with respect to those shares. If shares are held by an intermediary, meaning in a stock brokerage account or by a bank, trust or other nominee, then the broker, bank, trust or other nominee is considered the stockholder of record as to those shares. Those shares are said to be held in “street name” on behalf of the beneficial owner of the shares. Street-nameStreet-name holders generally cannot directly vote their shares and must instead instruct the broker or other nominee how to vote their shares using the voting instruction form provided by that broker or other nominee. Many brokers also offer the option of giving voting instructions over the internet or by telephone. Instructions for giving your vote as a street-namestreet-name holder are provided on your voting instruction form.

Quorum; Abstentions; Broker Non-VotesNon-Votes; Results

At the Annual Meeting, an inspector of elections will determine the presence of a quorum and tabulate the results of the voting by stockholders. A quorum exists when holders of a majorityone-third (1/3) of the stock issued and outstanding shares of stockand entitled to vote are present in person by remote communication, if applicable, or represented by proxy. A quorum is necessary for the transaction of business at the Annual Meeting.

Broker non-votesnon-votes can occur as to shares held in street name. Under the current rules that govern brokers and other nominee holders of record, if a street-namestreet-name holder does not give instructions to its broker or other nominee, such broker or other nominee will be able to vote such shares only with respect to proposals for which the broker or other nominee has discretionary voting authority.authority, i.e., “routine” matters under The Nasdaq Stock Market LLC, or Nasdaq, rules. A “broker non-vote”non-vote” occurs when a broker or other nominee submits a proxy for the Annual Meeting but does not vote on a particular proposal because such broker or other nominee either does not exercise its discretionary voting authority or does not have discretionary voting power with respect to that proposal and has not received instructions from the beneficial owner.

The approval of the election of directors (Proposal No. 1) is aonly “routine” proposal for which brokers do not have discretionary voting authority. If you hold your shares in street name and you do not instruct your broker howare being asked to vote on this proposal, your broker will not vote on them and those non-votes will be counted as broker non-votes. Theat the Annual Meeting is the ratification of the appointment of M&K CPAS, PLLC as our independent registered public accounting firm for the fiscal year ending December 31, 2022 (Proposal No. 2) isFour). The other proposals concerning the election of directors (Proposal One), say-on-pay (Proposal Two) and say-on-frequency (Proposal Three) are considered to“non-routine” matters, which means that your bank or broker will not be discretionary and your brokerage firm will be ablepermitted to vote on this proposal even if it does not receive instructions from you, as long as it holds your shares in its name.on any of the other proposals at the Annual Meeting unless you provide proper voting instructions. Accordingly, stockholders are urged to give their bank or broker instructions on voting their shares on all matters.

Abstentions and broker non-votesnon-votes are treated as shares present for the purpose of determining whether there is a quorum for the transaction of business at the Annual Meeting. For purposes

We intend to publish final voting results of the proposal to elect directors (Proposal No. 1) andAnnual Meeting in a Current Report on Form 8-K, which we expect will be filed within four business days of the proposal to ratify the appointment of M&K CPAS, PLLC as our independent registered public accounting firm (Proposal No. 2), abstentions and broker non-votesAnnual Meeting. If final voting results are not countedavailable to us in time to file a Current Report on Form 8-K within four business days after the Annual Meeting, we intend to file a Current Report on Form 8-K to publish results as to matters for determiningwhich we have final votes and, within four business days after the numberfinal results are known to us, file an additional Current Report on Form 8-K to publish the final results.

3

Required Votes and Voting

Each holder of common stock is entitled to one vote for each share held.

Assuming that a quorum is present at the Annual Meeting, the following votes will be required:

With regard to Proposal No. 1, the two nominees for election to the board of directors who receive the greatest number of votes cast “for” the election of the directors by the shares present, in person or by proxy, will be elected to the board of directors. Stockholders are not entitled to cumulate votes in the election of directors.With regard to Proposal No. 2, approval of this proposal requires the affirmative vote of a majority of shares of common stock present in person or by proxy.Proposal

Voting Options

Vote Required to

Adopt the

Proposal

Effect of

Abstentions

Effect of Broker

Non-Votes

1. Election of directors

For or withhold on each nominee.

Directors are elected by a plurality of the votes cast by the shares entitled to vote in the election. The three nominees for election to the board of directors who receive the greatest number of votes cast “FOR” the election of the directors by the shares present, in person or by proxy, will be elected to the board of directors.

No effect.

No effect.

2. Non-binding advisory vote on the compensation of our named executive officers for fiscal 2021 (“say-on-pay”)

For, against, or abstain.

The advisory vote on the compensation of our named executive officers is non-binding, but our board of directors will consider the input of stockholders based on a majority of votes cast for the say-on-pay proposal.

No effect.

No effect.

3. Non-binding advisory vote on the frequency of future non-binding advisory votes on the compensation of our named executive officers (“say-on-frequency”)

One year, two years, three years abstain.

The advisory vote on the frequency of future of non-binding votes on the compensation of our named executive officers is non-binding, but our board of directors will consider the input of stockholders based on the alternative that receives the most votes cast.

No effect.

No effect.

4. Ratification of Appointment of M&K CPAS, PLLC as our independent registered public accounting firm for fiscal year 2022

For, against, or abstain.

“FOR” votes from the holders of a majority of shares present and entitled to vote on this proposal.

Against.

Brokers have discretion to vote.

All shares entitled to vote and represented by properly executed, unrevoked proxies received before the Annual Meeting will be voted at the Annual Meeting in accordance with the instructions given on those proxies. If no instructions are given on a properly executed proxy, the shares represented by that proxy will be voted as follows:

FOR“FOR” each of the director nominees, “FOR” the approval of the compensation of our named in Proposal No. 1executive officers for fiscal year 2021, to hold the advisory vote on the compensation of this proxy statement;our named executive officers on an annual basis and

FOR Proposal No. 2, to ratify the “FOR” ratification of appointment of M&K CPAS, PLLC as our independent registered public accounting firm.firm for fiscal year 2022..

If any other matters are properly presented for consideration at the Annual Meeting, which may include, for example, a motion to adjourn the Annual Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named in the enclosed proxy and acting thereunder will have discretion to vote on those matters as they deem advisable. We do not currently anticipate that any other matters will be raised at the Annual Meeting.

Deadlines for Receipt of Stockholder Proposals

Stockholder proposals may be included in our proxy statement and form of proxy for an annual meeting so long as they are provided to us on a timely basis and satisfy the other conditions set forth in Rule 14a-814a-8 under the Securities Exchange Act of 1934, as amended, (the “Exchange Act”),or the Exchange Act, regarding the inclusion of stockholder proposals in company-sponsored

Required Votes and Voting

Each holder of common stock is entitled to one vote for each share held.

Assuming that a quorum is present at the Annual Meeting, the following votes will be required:

Proposal | Voting Options | Vote Required to | Effect of | Effect of Broker | ||||

1. Election of directors | For or withhold on each nominee. | Directors are elected by a plurality of the votes cast by the shares entitled to vote in the election. The three nominees for election to the board of directors who receive the greatest number of votes cast “FOR” the election of the directors by the shares present, in person or by proxy, will be elected to the board of directors. | No effect. | No effect. | ||||

2. Non-binding advisory vote on the compensation of our named executive officers for fiscal 2021 (“say-on-pay”) | For, against, or abstain. | The advisory vote on the compensation of our named executive officers is non-binding, but our board of directors will consider the input of stockholders based on a majority of votes cast for the say-on-pay proposal. | No effect. | No effect. | ||||

3. Non-binding advisory vote on the frequency of future non-binding advisory votes on the compensation of our named executive officers (“say-on-frequency”) | One year, two years, three years abstain. | The advisory vote on the frequency of future of non-binding votes on the compensation of our named executive officers is non-binding, but our board of directors will consider the input of stockholders based on the alternative that receives the most votes cast. | No effect. | No effect. | ||||

4. Ratification of Appointment of M&K CPAS, PLLC as our independent registered public accounting firm for fiscal year 2022 | For, against, or abstain. | “FOR” votes from the holders of a majority of shares present and entitled to vote on this proposal. | Against. | Brokers have discretion to vote. |

All shares entitled to vote and represented by properly executed, unrevoked proxies received before the Annual Meeting will be voted at the Annual Meeting in accordance with the instructions given on those proxies. If no instructions are given on a properly executed proxy, the shares represented by that proxy will be voted as follows:

FOR“FOR” each of the director nominees, “FOR” the approval of the compensation of our named in Proposal No. 1executive officers for fiscal year 2021, to hold the advisory vote on the compensation of this proxy statement;our named executive officers on an annual basis and

FOR Proposal No. 2, to ratify the “FOR” ratification of appointment of M&K CPAS, PLLC as our independent registered public accounting firm.firm for fiscal year 2022..

If any other matters are properly presented for consideration at the Annual Meeting, which may include, for example, a motion to adjourn the Annual Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named in the enclosed proxy and acting thereunder will have discretion to vote on those matters as they deem advisable. We do not currently anticipate that any other matters will be raised at the Annual Meeting.

Deadlines for Receipt of Stockholder Proposals

Stockholder proposals may be included in our proxy statement and form of proxy for an annual meeting so long as they are provided to us on a timely basis and satisfy the other conditions set forth in Rule 14a-814a-8 under the Securities Exchange Act of 1934, as amended, (the “Exchange Act”),or the Exchange Act, regarding the inclusion of stockholder proposals in company-sponsored

4

company-sponsored proxy materials. We currently anticipate holding our 2018 annual meeting of stockholders in May 2018, although the Board may decide to schedule the meeting for a different date. For a stockholder proposal to be considered timely pursuant to Rule 14a-814a-8 for inclusion in our proxy statement and form of proxy for the annual meeting to be held in 2018,2023, we must receive the proposal at our principal executive offices, addressed to our Secretary, no later than January 21, 2018.December 31, 2022. Any proposals received after

such date will be considered untimely. Submitting a stockholder proposal does not guarantee that it will be included in our proxy statement and form of proxy.

In addition, a stockholder proposal that is not intended for inclusion in our proxy statement and form of proxy under Rule 14a-814a-8 (including director nominations) shall be considered “timely” as calculated in accordance with Rule 14a-4(c)14a-4(c) under the Exchange Act, and may be brought before the 20182023 annual meeting of stockholders provided that we receive information and notice of the proposal addressed to our Secretary at our principal executive offices, no earlier than February 13, 2023 and no later than March 7, 2018.15, 2023.

Further, our Amended and Restated Bylaws, (our “Bylaws”)as amended, or Bylaws, provide that only such business shall be conducted at an annual meeting of stockholders as shall have been properly brought before the meeting. To be properly brought before an annual meeting, business must be brought in accordance with Section 2.4 of our Bylaws. A copy of our Bylaws can be found as Exhibit 3.5 to our Registration Statement on Form S-1 (Registration No. 333-213736) filed with the Securities and Exchange Commission (the “SEC”) on September 21, 2016 and incorporated herein by reference.

We strongly encourage any stockholder interested in submitting a proposal to contact our Secretary in advance of these deadlines to discuss any proposal he or she is considering, and stockholders may want to consult knowledgeable counsel with regard to the detailed requirements of applicable securities laws. All notices of stockholder proposals, whether or not intended to be included in our proxy materials, should be in writing and sent to our principal executive offices, located at: SenesTech, Inc., 314023460 N. Caden Court,19th Avenue, Suite 1, Flagstaff, Arizona 86004,110, Phoenix, AZ 85027, Attention: Secretary.

Paper Copy of Proxy Materials

If you want to receive a paper copy of these proxy materials, including any documents incorporated herein by reference but excluding exhibits to the Annual Report on Form 10-K, as amended, for the fiscal year ended December 31, 2021, or our 2021 Annual Report, you may request one at no cost to you by writing to: SenesTech, Inc., 23460 N. 19th Avenue, Suite 110, Phoenix, AZ 85027, Attention: Secretary.

Annual Report and Other Matters

Our 2022 Annual Report, which was made available to stockholders with or preceding this proxy statement, contains financial and other information about our company, but is not incorporated into this proxy statement and is not to be considered a part of these proxy materials or subject to Regulations 14A or 14C or to the liabilities of Section 18 of the Exchange Act. The information contained in the “Report of the Audit Committee” shall not be deemed “filed” with the SEC or subject to Regulations 14A or 14C or to the liabilities of Section 18 of the Exchange Act.

5

PROPOSAL NO. 1

ONE

ELECTION OF DIRECTORS

General

Our Bylaws provide that the authorized number of directors of the Company shall beour company are fixed by the board of directors from time to time. The board of directors has previously set the size of the board of directors at seveneight directors. The directors shall be elected at each annual general meeting of the stockholders. If for any reason directors are not elected at the annual meeting of theour stockholders, they may be elected at any special meeting of the stockholders that is duly called and held for that purpose in the manner provided by the Bylaws.

TheCurrently, the board of directors is divided into three classes. Except for the remainderclasses, and directors in each class are elected to serve a three-year term. The term of the initial terms for the Class II andcurrent Class III directors electedexpires at this year’s Annual Meeting. The term of the 2016Class I directors expires at our 2023 annual meeting of stockholders which initial terms are currently in progress, each director will serve a three-year term.and the term of the Class II directors expires at the 2024 annual meeting of stockholders. A director serves in office until her or his respectivea successor is duly elected and qualified, unless the director is removed, resigns or, by reason of death or other cause, is unable to serve in the capacity of director. We expect that anyAny additional directorships resulting from an increase in the number of directors willwould currently be distributed among the three classes so that, as nearly as possible, each class will consist of one third of the total number of directors.

Set forth below is certain information furnished to us byregarding the director nominees and by each of the incumbent directors whose terms will continue following the Annual Meeting. Loretta Mayer, our co-founder, chair of the board, chief executive officer and chief scientific officer, and Cheryl Dyer, our co-founder, president, chief research officer and a director, are married. Other than Drs. Mayer and Dyer, there are no family relationships among our directors or director nominees.

Nominees for Director

Two directors are to be elected at the Annual Meeting to the terms set forth below. The board of directors has nominated the following individuals for election to the board of directors: Julia WilliamsK.C. Kavanagh, Kenneth Siegel and Marc DumontMatthew Szot as Class IIII directors. The current Class III directors eachwill stand for re-election at our Annual Meeting of Stockholders subject to serveelection for a three-yearthree-year term until theexpiring at our 2025 annual general meeting of stockholders to be held in 2020 and until her or his successor is duly elected and qualified.stockholders.

Unless otherwise instructed, the proxy holders will vote the proxies received by themfor the election of Julia WilliamsMs. Kavanagh, Mr. Siegel and Marc DumontMr. Szot to the board of directors. Each of these individuals has indicated that shehe or heshe will serve if elected. We do not anticipate that any of these nominees will be unable or unwilling to stand for election, but if that occurs, all proxies received may be voted by the proxy holders for another person nominated by the board of directors. As there are twothree nominees, proxies may be voted for up to twothree persons.

Nominees and Continuing Directors

The following table sets forth the names and certain information as of the record date regarding the nominees and each director of our company continuing in office after the Annual Meeting:

Name of Director | Age | Position | Director | Term Expires | ||||

Marc Dumont | 79 | Director(1)(2) | 2016 | 2023 (Class I) | ||||

Jake Leach | 44 | Director(1) | 2020 | 2023 (Class I) | ||||

Jamie Bechtel, JD, Ph.D. | 49 | Chair of the Board and Director(2)(3) | 2018 | 2024 (Class II) | ||||

Delphine François Chiavarini | 46 | Director(1)(2) | 2018 | 2024 (Class II) | ||||

Phil Grandinetti III | 50 | Director(3) | 2020 | 2024 (Class II) | ||||

K.C. Kavanagh | 52 | Director(2) | 2020 | 2022 (Class III) | ||||

Kenneth Siegel | 66 | Chief Executive Officer and Director | 2019 | 2022 (Class III) | ||||

Matthew Szot | 47 | Director(1)(2)(3) | 2015 | 2022 (Class III) |

____________

(1) Member of the audit committee.

(2) Member of the nominations and corporate governance committee.

(3) Member of the compensation committee.

Director Nominees

K.C. Kavanagh has served as a director of our company since November 2020. Ms. Kavanaugh has served as Chief Communications Officer for AT&T Inc. since January 2022. Previously, Ms. Kavanaugh served as Chief Communications Officer for Bacardi Limited from October 2016 to May 2021. Prior to Bacardi Limited,

6

Ms. Kavanagh served as Senior Vice President of Global Communications for Starwood Hotels & Resorts, a branded lifestyle hospitality company, from September 2010 to September 2016. We believe that Ms. Kavanagh is qualified to serve as a member of our board of directors because of her experience in communications, marketing, branding and public relations as well as her superior leadership skills.

Kenneth Siegel has served as a director of our company since February 2019 and as our Chief Executive Officer since May 2019. From December 2016 to November 2018, Mr. Siegel served in key leadership roles at Diamond Resorts International Inc., a global vacation ownership company, most recently as President from March 2017 to November 2018. Prior to Diamond Resorts, from November 2000 to October 2016, he served in key leadership roles at Starwood Hotels & Resorts, a branded lifestyle hospitality company, most recently as Chief Administrative Officer and General Counsel from May 2006 to October 2016. Prior to joining Starwood in 2000, Mr. Siegel spent four years as the Senior Vice President and General Counsel of Cognizant Corporation and its successor companies, a multinational information technology services and consulting company. Mr. Siegel has a bachelor’s degree from Cornell University and a juris doctorate degree from New York University. We believe that Mr. Siegel is qualified to serve as a member of our board of directors because of his experience and knowledge in all facets of corporate operations and governance, including business, operational, corporate finance, mergers and acquisitions, marketing and branding gained as a senior executive of major public corporations.

Matthew Szot has served as a director of our company since December 2015 and serves as Vice-Chairman of the board and Chairman of our Audit Committee. From March 2010 to November 2021, he served as the Chief Financial Officer of S&W Seed Company, a Nasdaq-listed agricultural seed biotechnology company. Since September 2020, Mr. Szot has served on the board of directors and as Chairman of the Audit and Compensation committees of INVO Bioscience, Inc, a Nasdaq-listed medical device company. From June 2018 to August 2019, Mr. Szot served on the board of directors and as Chairman of the Audit Committee of Eastside Distilling, Inc. a Nasdaq-listed craft spirits company. From February 2007 until October 2011, Mr. Szot served as the Chief Financial Officer for Cardiff Partners, LLC, a strategic consulting company that provided executive financial services to various publicly traded and privately held companies. From 2003 to December 2006, Mr. Szot served as Chief Financial Officer and Secretary of Rip Curl, Inc., a market leader in wetsuit and action sports apparel products. From 1996 to 2003, Mr. Szot was a Certified Public Accountant with KPMG and served as an Audit Manager for various publicly traded companies. Mr. Szot has a Bachelor of Science degree in Agricultural Economics/Accountancy from the University of Illinois, Champaign-Urbana and is a Certified Public Accountant in the State of California. We believe that Mr. Szot is qualified to serve as a member of our board of directors because of his experience and knowledge of corporate finance, mergers and acquisitions, corporate governance, as well as other operational, financial and accounting matters gained as a past and present chief financial officer and director of other public and private companies.

Vote Required for Election of Directors

If a quorum is present, the nominees for election to the board of directors receiving the greatest number of votes cast “for”“FOR” the election of the directors by the shares present, in person or by proxy, will be elected to the board of directors.

Nominees and Continuing Directors

The names and certain information as of the record date about the nominees and each director continuing in office afterrepresented at the Annual Meeting are set forth below.

| Name of Director Nominees | Age | Position | Director Since | Term Expires | ||||

| Marc Dumont | 73 | Director | 2016 | 2017 (Class I) | ||||

| Julia Williams, M.D. | 57 | Director | 2011 | 2017 (Class I) |

| Name of Continuing Directors | Age | Position | Director Since | Term Expires | ||||

| Cheryl A. Dyer, Ph.D. | 65 | Director; President and Chief Research Officer | 2004 | 2018 (Class II) | ||||

| Loretta P. Mayer, Ph.D. | 67 | Chair of the Board, Chief Executive Officer and Chief Scientific Officer | 2004 | 2019 (Class III) | ||||

| Bob Ramsey | 71 | Director | 2016 | 2018 (Class II) | ||||

| Matthew Szot | 42 | Director | 2015 | 2019 (Class III) | ||||

| Grover Wickersham | 68 | Vice-Chair of the Board | 2015 | 2019 (Class III) |

Marc Dumontwaswill be elected to our board of directors for a three-year term.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE ELECTION OF EACH OF THE BOARD’S CLASS III DIRECTOR NOMINEES LISTED ON THE PROXY CARD.

Continuing Directors

Jamie Bechtel, JD, Ph.D. has served as a director of our company since January 2018. Dr. Bechtel is the founder of Kito Impact Foundation, a non-profit focused on integrating corporate social responsibility into small and medium sized businesses, and she has been the chief executive officer since February 2018. In addition, Dr. Bechtel was a co-founder of New Course, an organization focused on women-led conservation initiatives, and she has been a board member since August 2009. Dr. Bechtel holds a Ph.D. from Boston University, a law degree from Boston College and a bachelor’s degree from Boston University. We believe that Dr. Bechtel is qualified to serve as a member of our board of directors because she is a highly regarded leader in international conservation, and her work has led to strategic advances in the fields of conservation, sustainable finance and biology.

7

Delphine François Chiavarini has served as a director of our company since June 2018. Since June 2017, Ms. Chiavarini has served as vice president and general manager of U.S. at Moen, a faucet manufacturing company, where she is responsible for developing strategies for profitable growth, increasing Moen’s market share and ensuring winning execution in the U.S. market. Before joining Moen, from August 2014 to June 2017, Ms. Chiavarini was senior vice president and general manager of Food and Beverage North America at Ecolab, a global leader in water, hygiene and energy technologies and services that protect people and vital resources. Ms. Chiavarini earned both a bachelor’s and a master’s degree from Audencia Business School in Nantes, France, and attended executive programs at The University of Chicago Booth School of Business and the Wharton School of the University of Pennsylvania. We believe that Ms. Chiavarini is qualified to serve as a member of our board of directors because of her experience developing strategies for profitable growth and her experience as an executive at multiple companies.

Phil Grandinetti III has served as a director of our company since November 2020. In March 2013, Mr. Grandinetti co-founded WITHit, a wearable tech accessory company, and he has serves as its Chief Customer Officer. From February 2005 to March 2013, Mr. Grandinetti served as VP of Sales at LightWedge, a global e-book, e reader and tablet accessories brand. Prior to LightWedge, Mr. Grandinetti served as Sr. VP of Worldwide Sales of GSM Products, an innovative outdoor products company, from February 2002 to February 2005. Mr. Grandinetti has a J.D. from the University of San Diego School of Law and is licensed in the State of California, as well as a B.A. from the University of Iowa in Economics and Political Science. We believe that Mr. Grandinetti is qualified to serve as a member of our board of directors because of his experience with retail sales and marketing and the development and commercialization of new products.

Jake Leach has served as a director of our company since November 2020. Since joining DexCom, Inc., a company that develops, manufacturers, and distributes continuous glucose monitoring systems for diabetes management in March 2004, Mr. Leach served as Executive Vice President and Chief Technology Officer from September 2018 to the present, Senior Vice President of R&D from January 2015 to September 2018, and Vice President, R&D from January 2011 to January 2015. Mr. Leach holds a Bachelor of Science degree in Electrical Engineering with a minor in Biomedical Engineering from the University of California, Los Angeles. We believe that Mr. Leach is qualified to serve as a member of our board of directors because of his R&D and innovative technology experience coupled with his commitment to quality and extensive knowledge of domestic and international regulatory requirements.

Marc Dumont has served as a director of our company since January 2016. Mr. Dumont is owner, chairman and chief executive officer of Chateau de Messey Wineries Meursault,in Burgundy, France, a wine producer, a position he has held since March 1995. Mr. Dumont served as the president of PSA International SA (a PSA Peugeot Citroen Group company) from January 1981 to March 1995. He is an international financial consultant and advisor for clients in Europe and Asia,also serving as well as the United States. He has served as the chairman of Sanderling Ventures (a European affiliate of a U.S. venture capital firm) since 1996. In the past, Mr. Dumont has served as director of Finter Bank Zurich, Novalog/Winslow Corporation, NUKO Information Systems Inc. in San Jose, CA, and Banque Internationale in Luxembourg, all of which were public companies. Mr. Dumont holds a Degreedegree in Electrical Engineering and Applied Economics from the University of Louvain, Belgium and an MBA from the University of Chicago. We believe Mr. Dumont is qualified to serve as a member of our board of directors because of his experience and knowledge of corporate finance, international business development and operations, and his experience as a past director of other public and private companies.

Julia Williams, M.D. was elected to our board of directors in August 2011. She has been an emergency department physician since 1989. She has worked at Flagstaff Medical Center since 1999. Dr. Williams is the founder and President of Humanitarian Efforts Reaching Out, or HERO, a non-profit 501(c)(3) organization that provides humanitarian services including medical and dental care, alternative power sources, solar cookers, vitamins, eye glasses, nutritional support and animal care. HERO’s mission is to help build healthy sustainable communities in underdeveloped Nations around the world. Dr. Williams has received her Doctor of Medicine from the University of Maryland School of Medicine and her Bachelors of Science from the University of Maryland. We believe that Dr. Williams is qualified to serve as a member of our board of directors because of her medical and scientific background, commitment to and experience with animal care, and long commitment to our vision.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTEFORTHE ELECTION OF DR. WILLIAMS AND MR. DUMONT TO THE BOARD OF DIRECTORSAS CLASS I DIRECTORS, EACH TO SERVE FOR A THREE-YEAR TERM UNTIL THE ANNUAL GENERAL MEETING OF STOCKHOLDERS TO BE HELD IN 2020.

Cheryl A. Dyer, Ph.D.is one of our co-founders and has served as our president and a member of our board of directors since our inception in July 2004. She has served as our chief research officer since 2004, where she oversees all of our research activities for relevance to our business goals, adherence to scientific standards and assurance of regulatory, legal and contractual compliance. From June 1990 to September 1995, Dr. Dyer served as a NIH-funded Principal Investigator at The Scripps Research Institute, La Jolla, California and from 1995 to 2010 was on faculty at Northern Arizona University, Flagstaff, Arizona where she maintained an extramurally-funded research program and laboratory. She was the first Research Professor in the Department of Biology at Northern Arizona University and the first Established Investigator for the American Heart Association in the State of Arizona. Dr. Dyer earned a Bachelor’s degree in Biology from the University of California at San Diego in 1974 and a Ph.D. in Physiology and Pharmacology in 1986 in the School of Medicine at University of California at San Diego. Dr. Dyer was appointed as an Adjunct Member of the Graduate Faculty at Texas A&M University in 2015. We believe that Dr. Dyer is qualified to serve as a member of our board of directors because of her unique scientific background, her role as our co-founder and inventor of our first product, ContraPest.

Loretta P. Mayer, Ph.D.is one of our co-founders, and has served as our chair of the board since our inception in July 2004. Since June 2009, Dr. Mayer has served as our chief scientific officer. In December 2015, she assumed the title of chief executive officer, a position she previously held from June 2011 to January 2015. She is a co-inventor on the patent licensed from the University of Arizona that formed the basis for the launch of our research and development efforts and continues to contribute as co-inventor on additional patent improvements and new technology. Prior to her career in medicine and science, from 1978 to 1991 Dr. Mayer served as CEO of Binnacle Development, Inc., a California-based Real Estate Development company, where she established the first Senior Citizen Housing project in the city of San Diego, developed $45 million in product and managed an annual budget of $10 million. Dr. Mayer also served as Vice President of Soroptimist International of the Americas from 1990 to 1991, where she was responsible for NGO representation at United Nations and international board meetings, Cambridge, UK 1990 – 1991. She also served Soroptimist International of the Americas as a federation board member from 1988 to 1990 and as regional governor from 1984 to 1986. She earned a master’s degree in 1997 and a Ph.D. in 2000 in Biology from Northern Arizona University. Dr. Mayer earned a bachelors degree in Sociology from University of California, San Diego in 1971. She accepted a post-doctoral appointment with the College of Medicine at the University of Arizona in 2000. We believe that Dr. Mayer is qualified to serve as a member of our board of directors because of her scientific experience, business background and her role as our co-founder.

Bob Ramseywas elected to our board of directors in January 2016. Since 1978, Mr. Ramsey has served as chief executive officer of Starwest Associates, which develops and implements new business models in public partnerships for ambulance and EMS services. Mr. Ramsey also currently serves as chief executive officer of the Ramsey Social Justice Foundation, a non-profit organization that is dedicated to charitable work in the fields of global sustainability and affordable housing for at-risk and vulnerable populations, including women and children. The Ramsey Social Justice Foundation is a member of the Clinton Global Initiative. Mr. Ramsey has been appointed by six different Arizona governors to various Arizona state boards and commissions, including the Arizona Department of Health Services Emergency Medical Services Council on which he has served continuously since 1988. Mr. Ramsey holds a Bachelor of Arts from Arizona State University, and Arizona State University has named a school after Mr. Ramsey. We believe Mr. Ramsey is qualified to serve as a member of our board of directors because of his experience and knowledge of business development, global sustainability, charitable organizations and state and local government.

Matthew Szotwas elected to our board of directors in December 2015 and appointed as the chairman of the audit committee of our board of directors in December 2015 and as the chairman of the compensation committee of our board of directors in July 2016. Since March 2010, he has served as the chief financial officer and treasurer of S&W Seed Company, a Nasdaq-listed agricultural seed company. From February 2007 until October 2011, Mr. Szot served as the chief financial officer for Cardiff Partners, LLC, a strategic consulting company that provided executive financial services to various publicly traded and privately held companies. From 2003 to December 2006, Mr. Szot served as chief financial officer and Secretary of Rip Curl, Inc., a market leader in wetsuit and action sports apparel products. From 1996 to 2003, Mr. Szot was a Certified Public Accountant with KPMG and served as an Audit Manager for various publicly traded companies. Mr. Szot has a Bachelor of Science degree in Agricultural Economics/Accountancy from the University of Illinois, Champaign-Urbana and is a Certified Public Accountant in the State of California. We believe that Mr. Szot is qualified to serve as a member of our board of directors because of his experience and knowledge of corporate finance, mergers and acquisitions, corporate governance as well as other operational, financial and accounting matters gained as a past and present chief financial officer of other public and private companies.

Grover Wickershamwas elected to our board of directors and appointed as its vice-Chairman in December 2015. Mr. Wickersham also serves on the board of directors of S&W Seed Company, a Nasdaq-traded agricultural company, Eastside Distilling, Inc., an OTCQB-traded producer of high quality spirits, and Verseon Corporation, a London AIM-listed pharmaceutical development company. Since November 2016, Mr. Wickersham has served as the chief executive officer of Eastside Distilling, Inc. Mr. Wickersham has been a director and portfolio advisor of Glenbrook Capital Management, the general partner of a partnership that invests primarily in the securities of public companies, from 1996 to present. For

more than five years, Mr. Wickersham has served as the chairman of the board of trustees of Purisima Fund, a mutual fund advised by Fisher Investments of Woodside, California, which fund has assets under management of approximately $375 million. Between 1976 and 1981, Mr. Wickersham served as a staff attorney, and then as a branch chief, of the U.S. Securities and Exchange Commission. He holds an A.B. from the Univ. of California at Berkeley, an M.B.A. from Harvard Business School and a J.D. from Univ. of California (Hastings). We believe that Mr. Wickersham is qualified to serve as a member of our board of directors because of his experience and knowledge of corporate finance and legal matters, his experience and knowledge of operational matters gained as a past and present director of other public and private companies, and his knowledge of our company.

Executive Officers

The following table sets forth the names and certain information aboutregarding our executive officers as of the record date are set forth below:date:

Name | Age | Position | ||

Kenneth Siegel | 66 | |||

Chief Executive Officer and | ||||

Thomas C. Chesterman | 62 | |||

Executive Vice President, Chief Financial Officer, Treasurer and Assistant Secretary | ||||

Nicole Williams | 42 | Chief Strategy Officer | ||

Kim Wolin | 66 | Executive Vice President, Operations and HR and Secretary |

Drs. Mayer and Dyer’sMr. Siegel’s biographical details are set out above under the heading “Continuing Directors.”“Director Nominees” above.

TomThomas Chesterman joined our company in September 2015 and has served as our chief financial officerExecutive Vice President, Chief Financial Officer, Treasurer and treasurerAssistant Secretary since December 2015. He has over 2025 years of experience as the chief financial officer of a public company in the life science, technology and telecommunications industries. Most recently, he was the vice president and treasurer of General Communication Inc., a telecommunications company in Alaska, from 2013 to 2015. Previously, he was the chief financial officer of life science companies Bionovo Inc. from 2007 to 2012, Aradigm Corp. from 2002 to 2007 and Bio-RadBio-Rad Laboratories, Inc. from 1996 to 2002. Mr. Chesterman

8

is adept at a variety of capital market access techniques and has significant experience in developing the operational and financial infrastructures in companies to help support successful and rapid growth. Mr. Chesterman earned a bachelor’s degree from Harvard University and an MBAM.B.A. from the University of California at Davis.

Nicole Williams has served as Chief Strategy Officer of our company since May 2021 and has assumed leadership of the commercialization activities as of the end of 2021. Prior to joining our company, she was the National Director of Sales and Business Development in the orthopedic robotics division of Smith+Nephew, driving the adoption and commercialization of new technology with healthcare facilities across the country, from July 2018 to May 2021. From July 2017 to July 2018, Mrs. Williams served as Facility Administrator at DaVita Kidney Care. Previously, from September 2011 to July 2017, she was Assistant Vice President of Marketing and Public Relations for an HCA Level 1 Trauma Center driving service line growth, expansion of beds and services, and overall facility operations. Nicole’s 20-years of experience include sales and business development, operations, marketing and crisis communications. Nicole earned a bachelor’s degree at Boston University and an M.B.A. from the University of Denver.

Kim Wolin joined our company as a marketing technologist in May 2013 and inhas served as our Executive Vice President, Operations and HR and Secretary since May 2014 was appointed executive vice president of operations.2014. From January 2009 to May 2013, she was a vice president, branch sales and service manager of Sunwest Bank, a community bank located in Flagstaff, Arizona. From November 1996 to December 2009, Ms. Wolin held the positions of assistant vice president, branch manager and Licensed Financial Advisor at Wells Fargo Bank. She has owned and operated Creative Net Solutions, a website design and hosting business, since 1994. From 1984 to 1992, Ms. Wolin owned and operated Kodas Produce Market, a health food and organic produce store in Oakland, CA.California. Ms. Wolin earned a bachelor’s degree in Psychology from the State University of New York/York at Buffalo in 1977.

There are no family relationships among any of our directors and executive officers.

9

CORPORATE GOVERNANCE

Board of Directors Leadership Structure

Our Corporate Governance Principles provide our board of directors with flexibility in determining the appropriate leadership structure for our company. Our board of directors has elected to separate the roles of Chief Executive Officer and Chair of the Board. These positions are currently held by Kenneth Siegel, our Chief Executive Officer, and Jamie Bechtel, our Chair of the Board. The board of directors has adoptedbelieves that a leadership structure under whichthat separates these roles is appropriate for our company due to the vice-chairdifferences between the two roles. The Chief Executive Officer is responsible for setting our strategic direction, providing day-to-day leadership and managing our business, while the Chair of the Board provides guidance to the Chief Executive Officer, sets the agendas for and chairs board meetings, presides over executive sessions of the independent directors, establishes priorities and procedures for the work of the full board of directors and provides information to the members of our board of directors is an independent director and a separate role from our board chair and chief executive officer. We believe the current separationin advance of the vice-chair from the board chair and chief executive officer role allows the chief executive officer to focus her time and energy on running our business and managing our operations, while leveraging the experience and perspectives of an independent vice-chairman. Our chief executive officer has generally also been a member of the board of directors. Dr. Mayer is a director as well as our chief executive officer. We believe it is important to enable our chief executive officer to provide information and insight about us directly to the directors in their deliberations. Our board of directors believes that separating the board chair/chief executive officer and vice-chairman of the board roles is the appropriate leadership structure for us at this time and demonstrates our commitment to effective corporate governance.such meetings.

Our board chair is responsible for the effective functioning of our board of directors, enhancing its efficacy by guiding board of directors processes and presiding at board of directors meetings. Our board chair presides at stockholder meetings and ensures that directors receive appropriate information from our management to fulfill their responsibilities. Our board chair also acts as a liaison between our board of directors and executive management, facilitating clear and open communication between management and the board of directors.

Board of Directors Role in Risk Oversight

One of the key functions of our board of directors is informed oversight of our risk management process. Our board of directors willdoes not have a standing risk management committee, but rather intends to administeradministers this oversight function directly through our board of directors as a whole, as well as through various standing committees that address risks inherent in their respective areas of oversight. In particular, our board of directors is responsible for monitoring and assessing strategic risk exposure, and our audit committee has the responsibility to consideris responsible for considering and discussdiscussing our major financial risk exposures and the steps our management has taken to monitor and control these exposures. The audit committee also has the responsibility to issue guidelines and policies to govern the process by which risk assessment and management is undertaken and to monitor compliance with legal and regulatory requirements. Our compensation committee assesses and monitors whether any of our compensation policies and programs have the potential to encourage excessive risk-taking.risk-taking.

Director Independence

Generally, under the continued listing requirements and rules of Nasdaq, independent directors must comprise a majority of a listed company’s board of directors. Our board of directors has undertaken a review of its composition, the composition of its committees and the independence of each director. Our board of directors has determined that Dr. Bechtel, Ms. Chiavarini and Ms. Kavanagh, and Messrs. Dumont, Ramsey,Leach, Grandinetti and Szot and Wickersham, and Dr. Williams are independent within the meaning of Nasdaq listing standards and that none of such directors has any relationship with usour company that would interfere with the exercise of their independent business judgment. The board also determined that Kenneth Siegel, our current Chief Executive Officer, is not independent. Accordingly, a majority of our directors isare independent, as required under applicable Nasdaq rules. In making this determination, our board of directors considered the current and prior relationships that each non-employeenon-employee director has with our company and all other facts and circumstances our board of directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employeenon-employee director.

Additionally, in determining the independence of Dr. Bechtel, the board of directors considered her position as the chief executive officer of Kito Impact Foundation, which has provided consulting services for the past four years to the Company. Kito Impact Foundation received $50,400 per year for such services. These consulting services include partnership development and positioning services, with a focus on our company’s strategic agenda.

There are no arrangements or understandings between any director or nominee and any other person or entity other than our company pursuant to which the director or nominee receives compensation in connection with that person’s candidacy or service as a director.

Standing Committees and Attendance

The board of directors held a total of 14six meetings during 2016.2021. All directors attended more than 75% of the aggregate of the meetings of theour board of directors and committees thereof, if any, upon which such director served during the period for which he or shethe director has been a director or committee member during 2016.2021. The independent directors meet in executive session from time to time.

10

Our board of directors includesutilizes an audit committee, a compensation committee, and a nominating and corporate governance and nominating committee. Our audit, compensation and governancecommittee as standing committees are comprised solely of independent board members. In 2021, the audit committee held four meetings, the compensation committee held four meetings and the nominating and corporate governance committee held six meetings. Information about these standing committees and committee meetings is set forth below.

Our board of directors forms ad hoc committees from time-to-time to assist the board in fulfilling its responsibilities with respect to matters that are the subject of the ad hoc committee’s mandate.

Audit Committee

OurThe audit committee currently consists of Matthew Szot, who is the chair, of the committee, Grover WickershamDelphine François Chiavarini, Marc Dumont and Marc Dumont.Jake Leach. The board of directors has determined that, after consideration of all relevant factors, each of these directorsthe current audit committee members qualifies as an “independent” director under applicable SEC and NASDAQNasdaq rules. Each member of the audit committee is able to read and understand fundamental financial statements, including our consolidated balance sheets, consolidated statements of operations and consolidated statements of cash flows. Further, no member of the audit committee has participated in the preparation of our consolidated financial statements, or those of any of our current subsidiaries, at any time during the past three years. The board of directors has designated Mr. Szot as an “audit committee financial expert” as defined under applicable SEC rules and has determined that Mr. Szot possesses the requisite “financial sophistication” under applicable NASDAQNasdaq rules. The audit committee operates under a written charter setting forth the functions and responsibilities of the audit committee, which is periodically reviewed by the audit committee on an annual basis.and by the board of directors as appropriate. A current copy of the audit committee charter is available on our website athttp://senestech.investorroom.com/senestech.investorroom.com on the “Board Committees”“Documents and Policies” page under the heading “Corporate Governance.” The functions of the audit committee include:

• overseeing the engagement of our independent public accountants, including pre-approval of services and review of independence and quality control procedures of the independent public accountants;

• reviewing our accounting policies, judgments and assumptions used in the preparation of our financial statements;

• reviewing our audited financial statements and discussing them with the independent public accountants and our management;

• meeting separately with the independent public accountants and our management to consider the adequacy of our internal controls;

• establishing procedures regarding complaints concerning accounting or auditing matters, reviewing and, if appropriate, approving related-partyearnings press releases, related-party transactions, reviewing compliance with our Code of Business Conduct and Ethics, and reviewing our investment policy and compliance therewith; and

• reviewing our investment policy and financial plans, reporting recommendations to our full board of directors for approval and authorizing actions.

• discussing with our general counsel (if any) or outside counsel any legal matters brought to the Committee’s attention that could reasonably be expected to have a material impact on our financial statements.

Both our independent registered accounting firm and internal financial personnel regularly meet with our audit committee and have unrestricted access to the audit committee.

Compensation Committee

Our compensation committee currently consists of Matthew Szot,Jamie Bechtel, who is the chair, Phil Grandinetti III and Matthew Szot. Each of the current compensation committee Bob Ramsey and Julie Williams, each of whommembers has been determined by our board of directors to be independent in accordance with Nasdaq standards. Each member of our compensation committee is also a non-employeenon-employee director, as defined pursuant to Rule 16b-316b-3 promulgated under the Exchange Act, and an outside director, as defined pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended, or the Code.Act. The compensation committee operates under a written charter, which is periodically reviewed by the compensation committee on an annual basis.and by the

11

board of directors as appropriate. A current copy of the compensation committee charter is available on our website athttp://senestech.investorroom.com/senestech.investorroom.com on the “Board Committees”“Documents and Policies” page under the heading “Corporate Governance.” The functions of the compensation committee include:

• reviewing and, if deemed appropriate, recommending to our board of directors policies, practices, and procedures relating to the compensation of our directors, officers and other managerial employees and the establishment and administration of our employee benefit plans;

• reviewing, at least annually, our compensation philosophy;

• reviewing and recommending to the board of directors for approval the corporate goals and objectives relevant to the CEO and other executive officers;

• reviewing and approving any employment agreements, severance agreements or special compensation or change-in-control arrangements with executive officers;

• determining or recommending to the board of directors the compensation of our executive officers; and

• advising and consulting with our officers regarding managerial personnel and development.

• overseeing our compliance with the Nasdaq requirement that, with limited exceptions, stockholders approve equity compensation plans; and

• monitoring our compliance with applicable legal requirements of the Sarbanes Oxley Act of 2002 and the Dodd-Frank Wall Street Reform and Consumer Protection Act relating to employee compensation and benefits.

As part of its process to determine the compensation level of each executive officer, the compensation committee evaluates, among other things, the Chief Executive Officer’s assessment of the other executive officers and recommendations regarding their compensation in light of the goals and objectives of our executive compensation program. The compensation committee may delegate certain of its responsibilities, as it deems appropriate, to compensation subcommittees or to our officers, but it has not elected to do so to date.

Pursuant to its charter, the compensation committee has sole authority to retain and/or replace, as needed, any independent legal counsel, compensation and benefits consultants and other experts or advisors as the compensation committee believes to be necessary or appropriate.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee currently consists of Grover Wickersham,Delphine François Chiavarini, who is the chair, Jamie Bechtel, Marc Dumont, K.C. Kavanagh and Matthew Szot. Each of the current nominating and corporate governance committee Marc Dumont and Bob Ramsey, each of whommembers has been determined by ourthe board of directors to be independent in accordance with Nasdaq standards. The nominating and corporate governance and nominating committee operates under a written charter, which is periodically reviewed by the nominating and corporate governance committee on an annual basis and by the Boardour board of Directorsdirectors as appropriate. A current copy of the nominating and corporate governance committee charter is available on our website athttp://senestech.investorroom.com/ on the “Board Committees”“Documents and Policies” page under the heading “Corporate Governance.” The functions of the nominating and corporate governance and nominating committee include:

• evaluating the composition, compensation, size and governance of our board of directors and its committees and make recommendations regarding future planning and the appointment of directors to our committees;

• evaluating and recommending candidates for election to our board of directors;

• establishing a policy for considering stockholder nominees for election to our board of directors; and

• reviewing our corporate governance principles and providing recommendations to the board regarding possible changes.changes; and

• evaluating the performance of the Chief Executive Officer.

12

Director Nomination Process

The board of directors has determined that director nomination responsibilities should be overseen by the Nominatingnominating and Corporate Governance Committee (the “Committee”).corporate governance committee. One of the Committee’snominating and corporate governance committee’s goals is to assemble a Boardboard that brings to us a variety of perspectives and skills derived from high quality business and professional experience. Factors considered by the Committeenominating and corporate governance committee include character, judgment, knowledge, skill, integrity, diversity, (including factors such asincluding with respect to race, gender, ethnicity and experience), integrity,similar characteristics, age, expertise, length of service, independence, experience with businesses and other organizations of comparable size, including experience in animal and health sciences, business, finance, administration or public service, the relevance of a candidate’s experience to our needs and experience of other Boardboard members, familiarity with national and international business matters, experience with accounting rules and practices, the desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided by new members, and the extent to which a candidate would be a desirable addition to the board of directors and any committees of the board of directors. In addition, directors are expected to be able to exercise their best business judgment when acting on behalf of usour company and our stockholders, act ethically at all times and adhere to the applicable provisions of our codeCode of ethicsBusiness Conduct and business conduct.Ethics. Other than consideration of the foregoing and applicable SEC and Nasdaq requirements, unless determined otherwise by the Committee,nominating and corporate governance committee, there are no stated minimum criteria, qualities or skills for director nominees. However, the Committeenominating and corporate governance committee may also consider such other factors as it may deem are in the best interests of usour company and our stockholders. In addition, at least one member of the board of directors serving on the audit committee should meet the criteria for an “audit committee financial expert” having the requisite “financial sophistication” under applicable Nasdaq and SEC rules, and a majority of the members of theour board of directors should meet the definition of “independent director” under applicable Nasdaq rules. The board of directors is committed to actively seeking highly qualified women and individuals from underrepresented groups. The nominating and corporate governance committee and any search firm that it engages are directed to include women and candidates from underrepresented groups in each search pool form which the nominating and corporate governance committee selects director candidates.

The Committeenominating and corporate governance committee identifies director nominees by first evaluating the current members of the board of directors willing to continue in service. Current members of the board of directors with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination,re-nomination, balancing the value of continuity of service by existing members of the board of directors with that of obtaining a new perspective. The Committeenominating and corporate governance committee also takes into account an incumbent director’s performance as a Boardboard member. If any member of the board of directors does not wish to continue in service, if the Committeenominating and corporate governance committee decides not to re-nominatere-nominate a member for reelection, if the Boardboard decided to fill a director position that is currently vacant or if the board of directors decides to recommend that the size of the board of directors be increased, the Committeenominating and corporate governance committee identifies the desired skills and experience of a new nominee in light of the criteria described above. Current members of the board of directors and management are polled for suggestions as to individuals meeting the Committee’snominating and corporate governance committee’s criteria. Research may also be performed to identify

qualified individuals. Nominees for director are selected by a majority of the members of the Committee, with any current directors who may be nominees themselves abstaining from any vote relating to their own nomination.